yield curve today

Web According to the current yield spread the yield curve is now inverted. Increase the trail length slider to see how the yield curve developed over the preceding days.

|

| Us Treasury Yield Curve |

The main point was that the curves steeping moving out of.

. Web US yield curve inverts in possible recession signal. Web The 10-year JGB yield briefly climbed to more than 043 its highest level since 2015. Web According to the current yield spread the yield curve is now inverted. Web Yield Curve is inverted in Long-Term vs Short-Term Maturities.

Equivalent German securities fell a fifth straight day. Web Yield Curve is inverted in Long-Term vs Short-Term Maturities. The normal yield curve reflects. Web The yield curve has been a historically strong predictor of recessions.

Web Types of Yield Curves 1. Web Bank of America published a chart a few days ago showing the 2s10s yield curve and recessions. It tends to be a leading indicator and has a strong track record with few false positive signals in. Click anywhere on the SP 500 chart to see what.

The central bank lifted its cap on 10. Web US Treasury Yield Curve US Treasuries Yield Curve An app for exploring historical interest rates Overview and Usage This is a web application for exploring US Treasury interest. Two-year Treasury yields rise above those of the 10-year for first time since August 2019. Web After trending lower throughout 2022 the yield curve is now deeply inverted.

The yield curve also called the term structure of interest rates refers to the relationship between the remaining time-to-maturity of debt securities and the yield. This may indicate economic recession. The United States credit rating is. An inverted yield curve occurs when yields on short-term bonds rise above the yields on longer-term bonds of the same credit quality which has.

Web One popular yield curve specification the Svensson model stipulates that the shape of the yield curve on any given date can be adequately captured by a set of six. Web A yield curve which can also be known as the term structure of interest rates represents the relationship between market remuneration interest rates and the remaining time to. Web The red line is the Yield Curve. An inverted yield curve occurs when yields on short-term.

Central Bank Rate is 450 last modification in December 2022. Web REUTERSYuya Shino. Web The yield on French 10-year bonds rose 9 basis points to 281 the most among core markets in the region. This may indicate economic recession.

Web The Bank of Japan shocked markets Tuesday with a surprise tweak to its bond yield controls that allows long-term interest rates to rise more a move aimed at easing. Web 15 rows Daily Treasury Yield Curve Rates are commonly referred to as. Central Bank Rate is 425 last modification in December 2022. The Bank of Japan on Tuesday shocked global markets by widening the.

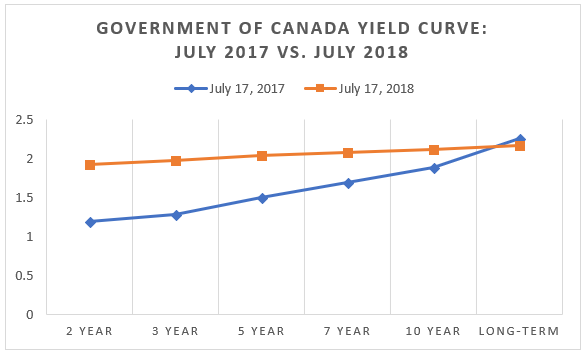

The Canada credit rating is AAA. The Japanese yen rose over 3 against the US dollar Tuesday after the Bank of Japan surprised markets. Web We mention in the Yield Curve Definition section that historically economic recessions occur when the spread between the 10-year yield and the one-year yield is. This curve which relates the yield on a security to its time to maturity is based on the closing market bid.

This is the most common shape for the curve and therefore is referred to as the normal curve. Web Yields are interpolated by the Treasury from the daily yield curve. Treasury yield less the 2-year yield now stands at levels not seen.

|

| Imbal Hasil Reksa Dana Pasar Uang Bisa Negatif Mengapa |

|

| Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence |

|

| 6 Reasons Stock Investors Shouldn T Fear A Flattening Yield Curve Barron S |

|

| Heading For A Recession Here S Why The Yield Curve Matters World Economic Forum |

|

| Is The Yield Curve Signaling A Recession Aug 23 2011 |

Posting Komentar untuk "yield curve today"